发布时间: 2018.11.30

文章作者: 楷博财经-Lily姚

您现在的位置:楷柏财经首页>国际证书培训>证书资讯>考前冲刺

最近后台有很多楷博学子留言,强烈要求楷博君发一些SBR的考前推文。为满足学子们的愿望,帮助大家更好的复习备考,楷博财经特邀姚立老师为大家深入解析“从P2到SBR有哪些考纲上的区别变化?”不仅如此,姚立老师还为大家总结了“How to solve Ethical questions”相关解题要点。希望大家好好复习,考出好成绩,不负自己不负老师的期望!

1

01

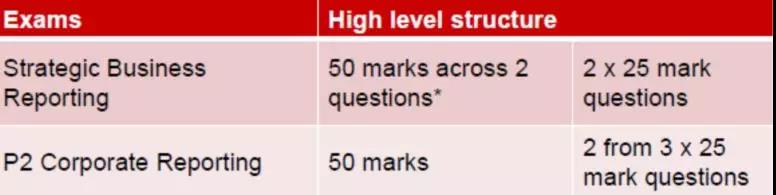

考试形式的变化

变化前(P2):

Section A: Q1(50分)考察内容为合并报表的制作及少量道德和会计实务的处理。

Section B: Q2-Q4 (2*25分),Q2-Q4中任选两道。Q2和Q3为准则应用的case题,Q4为偏重于current issue的essay题。

变化后(SBR):

Section A: Q1-Q2(共50分,具体分值分配不定)。Q1考察内容为报表合并中的会计处理。Q2为会计实务处理和其中的道德影响。

Section B: Q3-Q4 (2*25分)。均为准则应用的case题,current issue不再单独考察,该知识点融入整张试卷进行考察。

02

考试内容的变化

1. 计算大幅缩水

以前Q1中35分的合并报表制作没有了,现在Q1更偏向于对合并中数据的解释和分析,至于大家擅长的计算,分值只在10分左右。从这点看,所以考试的转型增加了通过难度。

2. 道德题怒刷存在感

在P2的年代,道德题主要出现于Q的(b)(c)问,分值在5分左右。而现在,通过几套样卷的分析,这部分知识内容均在20分左右。然而,大家完全不需要害怕这种“新生代”考题,本人认为,这是P2转型后最大的福利,套路多多,后面会给大家具体分析。

3. Q4 Essay题被删除

Q4选做题被删除并不代表着current issue不会被考到,current issue 会渗到其他题目当中进行考察, 但相信该部分分值不会大。所以大家还是和以前一样,把考官文章看懂即可,不用花太多时间去准备这块内容。

4. 准则应用case题为必做题

准则应用题一直是这门学科的重难点,在这次转型中,对准则应用题的考察难度基本没变化。所以历年真题中的Q2Q3仍然是大家宝贵的复习资料。

5. conceptual framework和integrated reporting被强化

现在的SBR,可能会更多的让考生以概念框架为出发点去回答问题,所以大家需要扎实的掌握conceptual framework的内容。integrated reporting 本是以前P1的重点,P2 很少考。现在考官有专门点出这块内容会在SBR中考查,所以希望大家把那6个capital弄清楚。

6.新增财务数据的分析(APM)

F7和F9当中,我们已经系统学习了对传统财务报表数据进行分析。SBR的这次改革新增了additional performance measures(APM)这个知识点。APM其实就是对财务报表数据进行一些调整,目的是帮助财务报表使用者更好的进行经济决策。那么我们需要学会的是判断哪些调整是为了达成目的,而哪些调整只是高管用于粉饰公司业绩的手段。而这些判断本质上依赖于我们对于国际财务会计准则的理解和道德行为认知,从这点上来说也不算是全新的知识。大家可以通过样卷(官网上可下)感受下这块内容。

03

考试难度的变化

结合考试形式和考试内容的变化,我认为考试通过难度与往年是持平的。虽然计算分值变少,文字表达能力要求变高,但是道德模块的引入,平衡了整体试卷的难度。所以,接下来给大家来详细分析下道德相关知识点。

2

Part1

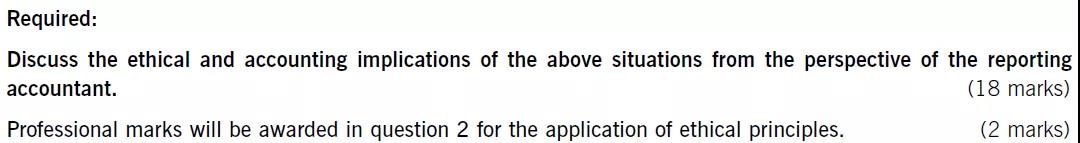

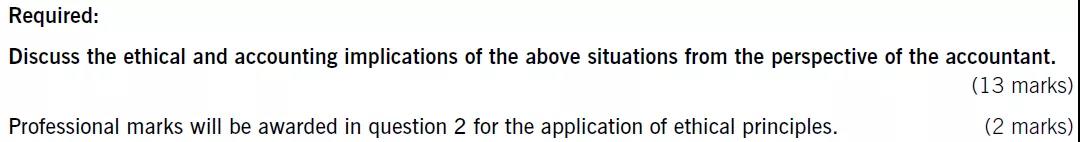

Examples of ethical questions 题型示例

🔘 Specimen exam (1) : Q2 Abby

🔘 Specimen exam (2) : Q2 Gustoso

🔘 201809: Q2 Farham

Part2

Fundamental principles of Ethical codes 道德基本准则

a) Integrity

Be straightforward and honest in all professional and business relationships.

Any attempt to conceal or hide transactions, either through omitting them or through inadequate or confusing disclosure, demonstrates a lack of integrity. For example, overstate revenue, hide the impact on environment and so on.

b) Objectivity

Do not allow bias, conflict of interest or undue influence of others to override professional or business judgments.

c) Professional Competence and Due Care

To maintain professional knowledge and skill at the level required to ensure that a client or employer receives competent professional services based on current developments in practice, legislation and techniques and act diligently and in accordance with applicable technical and professional standards.

d) Confidentiality

Do not disclose any confidential information to third parties without proper and specific authority, unless there is a legal or professional right or duty to do so.

Do not use the information for the personal advantage of the professional accountant or third parties.

e) Professional behavior

To comply with relevant laws and regulations and avoid any action that discredits the profession.

Part3

Distribution of exam marks (e.g:Rashford) 分值分布

Rashford is a quoted company that conducts its business on a worldwide basis. The newly appointed reporting accountant has been reviewing the draft financial statements that have been prepared by the finance director.

🔘 Investment property

The reporting accountant has discovered that the Rashford owns several investment properties that are rented out to tenants. One of the investment properties is a block of luxury apartments where one of the tenants is a company controlled by another director’s husband. The rent payable on this luxury apartment is in arrears and has been written off by Rashford. As Rashford is a multinational company the amount of the write off is immaterial in the context of Rashford’s draft profit, and on that basis finance director argues that no disclosure is required. The fair values of these assets have recently fallen and the losses have been recognised directly in equity.

🔘 Intangible assets in development

During the year it became apparent that a development project was no longer going to be technically feasible or commercially viable, when, in the final stages of testing unexpected defects were discovered. The finance director has written off capitalized development expenditure that was recognized as an intangible non-current asset as a prior period adjustment. The finance director has argued that the company should have known that the development project was never going to be successful that it represents a mistake of a previous period not to write off the asset.

In the draft accounts all non-current assets have had their estimated useful lives revised upwards by 10%. No justification has been advanced for this revision of an estimate.

🔘 Share based payments

The finance director is due to retire next year and has a substantial number of share options that were issued at the start of the year and are due to vest shortly after the current year’s results are announced. No charge has been made in the financial statements in respect of the options granted to the director on the basis that the options were hard to value correctly and that it did not cost the company anything to issue the options.

The finance director has assured the reporting director that she will support his appointment as her successor if he follows her suggested accounting treatments.

Discuss the ethical and accounting implications of the above situations from the perspective of the reporting accountant. Consider the courses of action open to the reporting accountant and the potential impact on stakeholders if the finance director’s suggested accounting treatments are adopted in the final financial statements. (20 marks)

Two professional marks will be awarded in question 2 for the application of ethical principles.

Part4

Sample answer of Rashford Co 答案示例

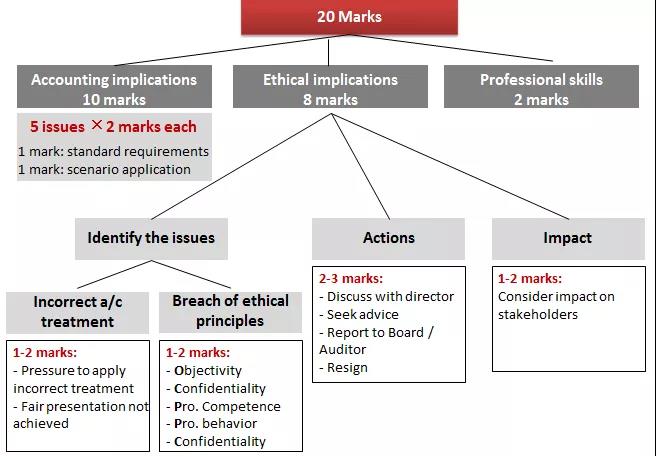

🔘 Accounting implications (5*2=10 marks)

☑ Investment property

IAS 40 says the property held by the owner to earn rentals, capital appreciation can be recognized as investment property.

In this case, the luxury apartments are correctly classified as investment property, because they are held for their investment potential (rental).

Rashford uses the fair value model. In such case, gain or loss should be recognised in P/L, not directly to equity.

☑ Related party transaction

One of the tenants is a company controlled by spouse of the key management team. This makes it a related party to Rashford.

IAS 24 requires the amount written off and the nature of the related party transaction be disclosed outside.

☑ Intangible assets in development

The intangible asset of development is no longer to give further economic benefit because it is neither technically feasible nor commercially viable. It is therefore correct to have written it off. Since the recognition of the item has changed, it belongs to the change of accounting policy and should be applied retrospectively. The director accounted for the event correctly.

☑ Non-current assets

It is correct to review the useful life of PPE at each year end. The useful life change belongs to changes in accounting estimate and should be applied prospectively. However, the change of useful life in this case appears to be arbitrary and no justification is available.

☑Share based payments

According to IFRS 2, share options granted to directors must be presented to profit or loss during the vesting period at grant date fair value. IFRS 13 fair value can be helpful when determines the fair value.

Although there is no cash outflow, the company should recognize remuneration expense since the directors provides service. Not to charge will overstate profits.

🔘 Ethical issues (4 marks)

1.IAS 1 Presentation of Financial Statements requires financial statements should be prepared fairly and faithfully, and enable stakeholders, such as banks and shareholders, to make decisions.

2. Directors have a responsibility to act honestly and ethically and not be motivated by personal interest and gain. If the ethical conduct of the directors is questionable then other areas of the financial statements may need scrutiny.

3. It is important that accountants identify issues of unethical practice and act appropriately in accordance with ACCA's Code of Ethics.

4. The errors have been a pattern of overstating profit and hiding related party transactions, which benefits the director. The codes of integrity, objectivity and professional behavior have been seriously breached.

🔘 Action (advice to accountant) (4 marks)

1.The accountant should discuss the matters with the director. The technical issues should be explained and the risks of non-compliance explained to the director. The discussion should try to confirm the facts and the reporting guidance which needs to be followed. Financial reporting does involve judgment but the cases above seem to be more than just differences in opinion.

2. If the director refuses to comply with accounting standards, then it would be appropriate to discuss the matter with others affected such as other directors and seek professional advice from the ACCA and auditors. Legal advice should be considered if necessary.

3. The accountant should keep a record of all conversations and actions. As a final resort, resignation should be considered if the matters cannot be satisfactorily resolved.

🔘 Impact (2 marks)

When the unethical practice becomes known, the share price will fall and the value of an entity would be affected. This will result in losses for investors.

感谢姚立老师的倾情分享

近期,我们也将持续以直播/文章的形式,

为大家推送各个科目的考前干货,

请持续关注楷博财经官网或微信公众号哦~

发布时间: 2018.11.30

文章作者: 楷博财经-Lily姚